By Zina Edwards, Hal Lloyd and Monty Loughlin

In January 2016, the International Accounting Standard Board issued the new lease standard (IFRS 16 Leases). This new standard and the equivalent Australian standard (AASB 16) will be effective for annual reporting periods beginning on or after 1 January 2019 (with early adoption being optional).

The new lease standard almost eliminates off-balance sheet accounting for lessees which will have a significant impact on the financial statements of certain companies that currently lease assets of significant value. If not carefully considered, the new lease standard could also have unintended consequences on finance and corporate transactions entered into by such companies.

Overview

Under existing accounting standards, companies that enter into lease transactions as lessees can either account for those transactions on or off-balance sheet depending on whether the lease is a finance lease (on balance sheet) or an operating lease (off-balance sheet). The difference between the two being based on complex accounting rules and, often, value judgements.

In January 2016, the International Accounting Standards Board issued the new lease standard IFRS 16 Leases. Equivalent provisions have been adopted in Australia as AASB 16. The new standard will become effective for annual reporting periods beginning on or after 1 January 2019. While early adoption of the standard was optional, few companies have chosen to adopt the standard. For most companies the 2019 reporting period will be the first time the new standard is implemented.

The new accounting standard requires that companies bring all leases with a term of more than 12 months (other than for leases of assets under $5,000) on balance sheet. By bringing operating leases on balance sheet, the new accounting standard will arguably give a more accurate representation of a company’s financial position as the amounts and timing of cash flows from operating leases will be reflected as current and non-current liabilities. Companies will also have to report the ‘right-of-use’ value of the underlying lease asset as a non-current asset.

Given that many companies lease a substantial number of high value assets such as premises, machinery and equipment, the new accounting standards could significantly alter the balance sheet position of such companies.

The changes in how operating leases are reported may also have a corresponding impact on the calculation of key performance ratios and debt covenants that are commonly contained in a company’s finance documents. The changes could also have unintended consequences for corporate transactions that apply accounting concepts to working capital and net debt adjustments.

Impact on financial statements

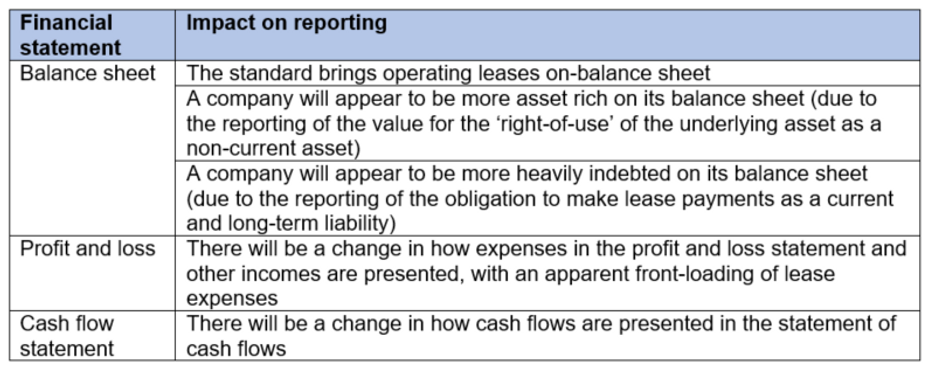

While it is not the intention of this article to go into the details of the new accounting standard, at a high-level IFRS 16 will have the following impact on a company’s financial statements:

Potential impact on finance documents

While it is common for key performance ratios and financial debt covenants in finance documents to be applied on a ‘frozen GAAP’ basis (ie not to be affected by changes in accounting standards), not all finance documents contain such provisions.

For those arrangements and other measures that are not usually applied on a ‘frozen GAAP’ basis (such as EBITDA), the new standard could have a significant impact on a number of key performance ratios and debt covenants typically found in finance documents, including but not limited to: equity ratios, liquidity and solvency ratios, EBITDA and other profitability ratios, and return on asset ratios.

The transition to IFRS 16 may also impact ‘Finance Debt’ provisions within facility documents. Where a company enters into a debt facility with a financier, such provisions typically permit or restrict the company from incurring further indebtedness to another financier with associated representations, warranties, undertakings and events of default (including cross default triggers for failing to pay ‘Finance Debt’ when it falls due).

For example, it is not uncommon for the definition of ‘Finance Debt’ in a facility agreement to extend to a ‘Finance Lease’, being a lease often defined in the facility agreement as a lease liability which would be treated as a balance sheet liability in accordance with the accounting standards. With operating leases being brought on-balance sheet, a consequence is that an existing operating lease that was not contemplated within the definition of ‘Finance Lease’ and ‘Finance Debt’ at the time the facility agreement was entered into will soon fall within these definitions.

Companies impacted by these changes should consider if their operating leases will fall within the permitted debt provisions under its finance documents, its ability to continue to make the representations, warranties and undertakings as to any finance debt, and the increased exposure to default risk under any cross-default clause.

Potential issues for corporate transactions

The changes could also affect the terms of working capital and net debt adjustments in share sale agreements. For example, for agreements straddling the implementation period, it would be typical to include provisions requiring completion accounts to be prepared on the same basis as the accounts on which the target working capital is based. These provisions usually present a waterfall requiring the accounts to be prepared first in a manner consistent with any specified principles in the agreement, then on a basis consistent with prior practice and if neither apply on a basis consistent with accounting standards. It will be important that the third limb in this waterfall apply the historical accounting standards and not the new accounting standards.

After the new standard becomes effective, definitions of “debt” in share sale agreements, used to define net debt for a cash free, debt free adjustment will need some thought to ensure that the correct items are captured. The definition of debt would usually capture finance leases but not operating leases. Some care will need to be taken by the seller to ensure that the net debt adjustment does not capture items that would not typically be considered debt in the context of a net debt adjustment.

Preparing for IFRS 16

IFRS 16 is part of a wave of changes to accounting standards that companies have been required to apply in recent times, including new standards on financial instruments and the new revenue standard. In preparation for the implementation of IFRS 16 and when considering its impact on finance and corporate transactions, companies should review their existing arrangements to identify the key performance ratios, debt covenants and finance debt provisions that may require renegotiation before the new standard becomes effective. In M&A transactions, care should be taken to apply the accounting standards fallback appropriately for working capital adjustments and for definitions of debt in net debt adjustments.

The information contained in this article is for information purposes only and does not constitute legal advice.

About the Authors

Hal Lloyd is a Partner at Hamilton Locke and has more than 20 years’ experience in mergers and acquisitions, private equity, capital raising and distressed transactions across a number of industry sectors.

Zina Edwards is a Partner at Hamilton Locke and has extensive experience advising major trading and investment banks, syndicates, funds and public companies in relation to various high profile and complex financial turnarounds, restructurings and special situations.

Monty Loughlin is a lawyer at Hamilton Locke and is experienced in advising financial institutions and funds, strategic investors and creditors, public companies and insolvency practitioners in financial turnarounds, distressed transactions, restructurings, formal insolvencies, and related disputes.